Attain Financial Quality With Aid From Succentrix Business Advisors

Attain Financial Quality With Aid From Succentrix Business Advisors

Blog Article

Exactly How a Company Accountancy Expert Can Assist Your Company Thrive

In today's competitive company landscape, the expertise of a service accounting consultant can offer as an essential property to your business's success. The complete level of their impact extends past these basics, exposing much deeper insights that can essentially change your organization trajectory.

Financial Preparation Techniques

Effective financial planning techniques are vital for organizations intending to attain lasting security and growth. These methods include a detailed technique to handling economic resources, forecasting future revenues, and optimizing costs. By establishing clear financial objectives, companies can produce actionable strategies that line up with their general company objectives.

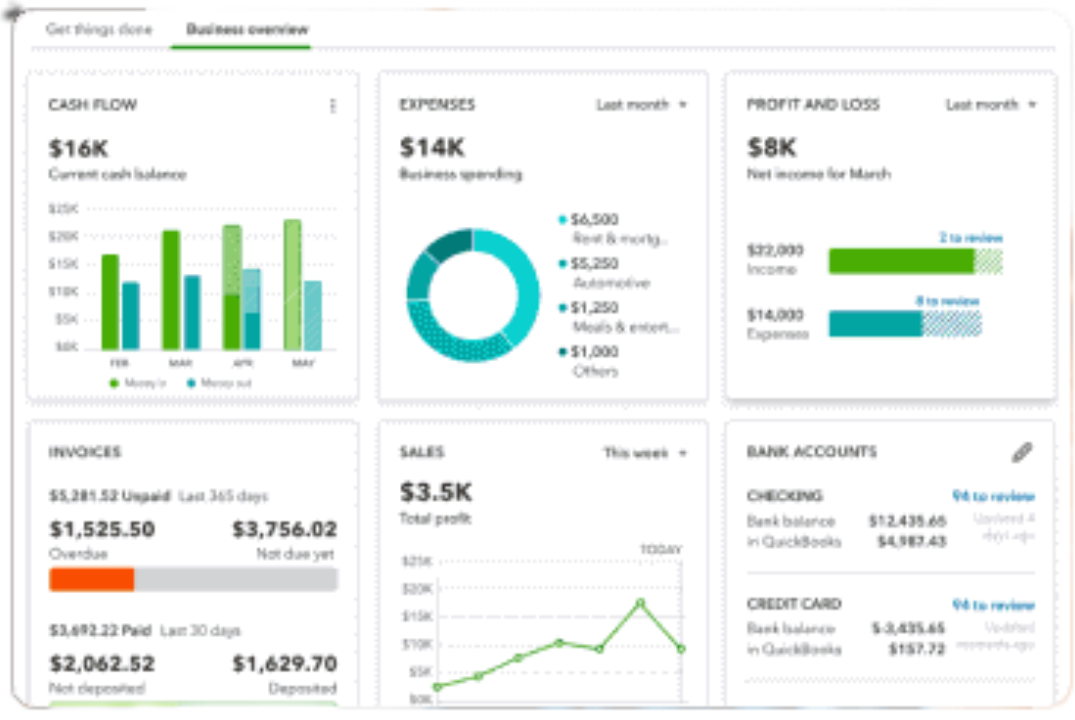

Key parts of efficient financial planning consist of capital budgeting, situation, and management analysis. Cash circulation administration guarantees that services preserve sufficient liquidity to fulfill functional needs while likewise preparing for unpredicted costs. A well-structured budget acts as a roadmap for assigning resources successfully and keeping an eye on monetary performance. Circumstance analysis enables organizations to prepare for various market problems, aiding them to adapt their methods as necessary.

In addition, normal monetary reviews are vital to assess the effectiveness of planning techniques and make essential changes. Involving with a business accounting advisor can enhance this process, providing experience in economic modeling and threat assessment. By executing robust financial planning strategies, companies can navigate economic unpredictabilities, take advantage of growth possibilities, and inevitably secure their financial future.

Tax Optimization Strategies

Tax obligation optimization techniques play a vital function in enhancing a business's overall monetary wellness. By tactically handling tax obligation liabilities, business can considerably boost their cash flow and reinvest financial savings right into growth chances. One effective method is the mindful choice of service structures, such as S-Corporations or llcs, which can give tax obligation advantages based on the details requirements of the organization.

Furthermore, taking advantage of tax credit reports and deductions is essential. Businesses must frequently review qualified deductions for costs like research and growth, energy-efficient upgrades, and employee training programs. Making use of tax loss harvesting can also help in offsetting taxed income by marketing underperforming properties.

Moreover, executing a tax deferral method allows services to postpone tax settlements, consequently retaining funds for longer periods. This can be completed through retired life plans or financial investment accounts that offer tax obligation advantages.

Finally, involving with a well-informed business audit consultant can assist in the identification of these possibilities and ensure conformity with ever-changing tax obligation policies. By using these methods, companies can successfully decrease their tax problem and allot sources a lot more successfully toward accomplishing their critical purposes.

Capital Management

Cash circulation monitoring is vital for keeping the monetary security and operational effectiveness of a company. It includes the surveillance, analysis, and optimization of money inflows and outflows to make sure that a firm can fulfill its commitments while going after development chances. Efficient capital administration enables services to preserve liquidity, prevent unnecessary financial obligation, and prepare for future costs.

A service audit advisor plays a critical duty in this process by offering professional assistance on capital budgeting, forecasting, and expenditure management. They can help recognize fads in capital patterns, allowing services to make enlightened choices relating to expenses and investments. By implementing durable money management approaches, consultants can aid in bargaining beneficial payment terms with suppliers and maximizing balance dues processes to accelerate cash money inflow.

Moreover, a business audit consultant can give insights right into seasonal fluctuations and cyclical fads that may affect capital. This aggressive method makes it possible for companies to plan for potential deficiencies and to take advantage of opportunities throughout height periods. On the whole, efficient cash flow monitoring, sustained by a well-informed advisor, is crucial for guaranteeing a business's long-lasting sustainability and success.

Performance Evaluation and Reporting

Performance analysis and reporting are important parts of calculated business administration, supplying critical insights into functional performance and financial health. By systematically reviewing key performance signs (KPIs), businesses can evaluate their development towards purposes and identify areas needing enhancement. This analytic procedure makes it possible for companies to comprehend their monetary setting, consisting of profitability, effectiveness, and expense administration.

An organization accounting advisor plays a pivotal role in this procedure, using innovative logical devices and techniques to provide specific performance reports. These records highlight trends, differences, and possible operational bottlenecks, permitting companies to make educated decisions (Succentrix Business Advisors). Furthermore, the consultant can promote benchmarking versus market criteria, which enables companies to determine their efficiency relative to competitors.

By focusing on data-driven understandings, companies can boost their functional approaches and keep an affordable edge in the market. Eventually, effective performance evaluation and reporting equip companies to thrive by straightening their sources with their tactical objectives and promoting lasting growth.

Risk Management and Conformity

Although businesses pursue development and earnings, they should also prioritize threat monitoring and compliance to protect their operations and credibility. Effective risk administration entails recognizing potential risks-- financial, functional, or reputational-- and establishing techniques to mitigate those threats. This positive approach makes it possible for companies to navigate unpredictabilities and shield their properties.

Conformity, on the various other hand, makes certain adherence to regulations, regulations, and market standards. Non-compliance can cause serious penalties and damages to a firm's credibility. A business audit consultant can play an important role in developing durable compliance frameworks customized to certain market requirements.

By carrying out normal audits and analyses, these consultants assist services identify conformity spaces and apply restorative activities. Furthermore, they can help in establishing inner controls and training go to the website programs that promote a culture of conformity within the company.

Including danger monitoring and compliance right blog into the general organization approach not just lessens potential interruptions but also boosts decision-making procedures. Eventually, the knowledge of a service audit consultant in these areas can result in lasting development and lasting success, ensuring that business stay durable in an ever-changing service landscape.

Conclusion

In verdict, the proficiency of a business accounting expert is crucial in cultivating business success. Inevitably, the calculated partnership with a company accountancy advisor positions a firm to exploit on growth chances while alleviating possible monetary obstacles.

In today's competitive service landscape, the proficiency of a business accountancy advisor can serve as a crucial possession to your firm's success. Involving with a company accountancy advisor can enhance this process, giving knowledge in monetary modeling and threat analysis - Succentrix Business Advisors. By implementing durable economic preparation techniques, services can browse financial uncertainties, take advantage of on development opportunities, and eventually safeguard their economic future

One reliable approach is the careful choice of organization structures, such as S-Corporations or llcs, which can supply tax obligation benefits based on the certain demands of the company.

Eventually, the critical partnership with a service accounting consultant positions a firm to click for info take advantage of on development opportunities while reducing prospective economic difficulties.

Report this page